[Our Stories] 'Banking in Your Hand': LINE Bank's Journey Through 2021

2021.12.28 ALL

The year 2021 has been a momentous one for LINE Bank. We launched in both Taiwan and Indonesia, while our services in Thailand surpassed one major milestone after another. As we close out the year, we wanted to take a look back at some of the high points we passed along our journey through this year:

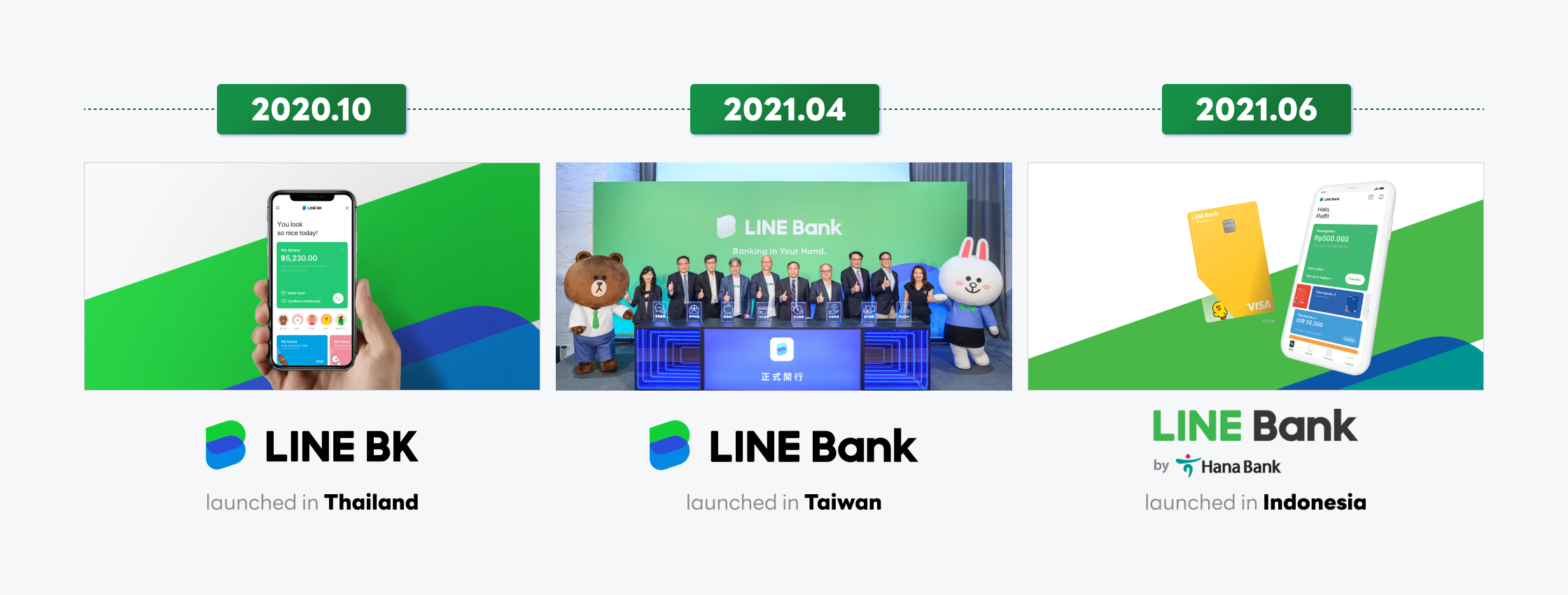

LINE Bank launches in Taiwan and Indonesia

LINE Bank began operations in Taiwan and Indonesia in 2021, following the launch of LINE BK in Thailand in October 2020.

In April, LINE Bank officially kicked off in Taiwan, bringing a new generation of internet-only banking to the people of Taiwan via their most frequently used app. Under the slogan “Banking in Your Hand,” LINE Bank offers a wide range of easy-to-use financial services—including transfers between friends, a debit card, Taiwan dollar deposits and personal installment loans—through the LINE messenger.

Then in June, we opened LINE Bank by Hana Bank (or just “LINE Bank,” for short) in Indonesia, a collaboration between PT Bank KEB Hana Indonesia and LINE Financial Asia. LINE Bank aims to target the Indonesian financial market by providing convenient digital banking services, combining LINE's tech expertise and the financial know-how of Hana Bank. In Indonesia in particular, due to this market’s unique geographical characteristics and the large numbers of "unbanked" people, bringing banking services to people’s mobile phones has the potential to greatly increase their availability and convenience.

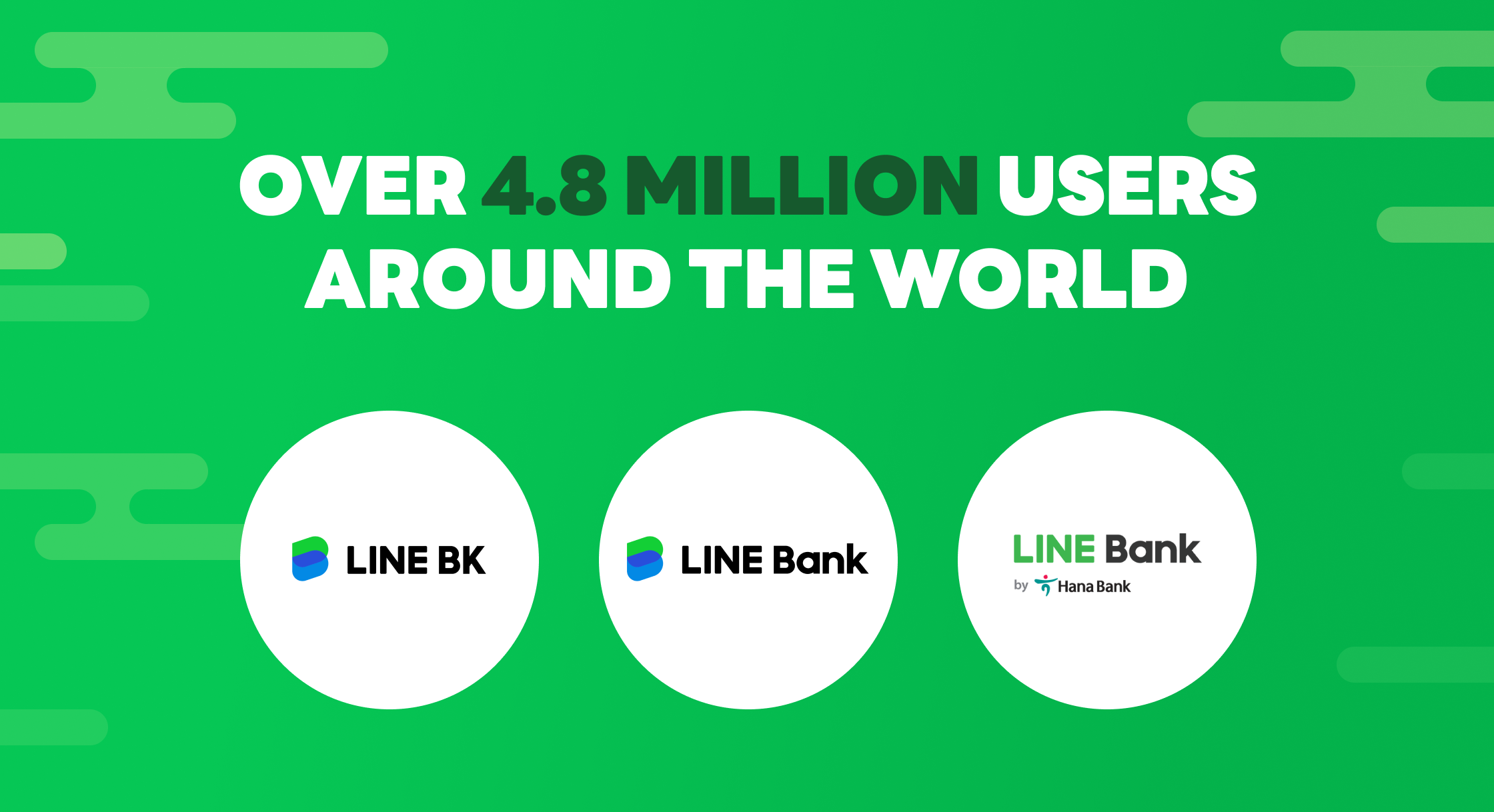

4.8 Million Global Users!

As of December, LINE Bank has surpassed 4.8 million users around the world.

For Thailand, LINE BK, in partnership with KBank, has achieved 3.9 million users, 4.5 million saving accounts and 2 million debit cards.

In Taiwan, LINE Bank has over 600,000 users, plus it has been awarded the information security certificates ISO/IEC 27001:2013 (for information security management systems) and BS 10012 (personal information management system). These certifications demonstrate that LINE Bank is dedicated to following international standards in information security and personal data protection, embedding the "Secure by Design" approach in our digital finance services to protect users’ transactions and information security.

As for LINE Bank in Indonesia, our service there has surpassed 300,000 users as of December — and in the first half of 2022, we will roll out a range of additional services, such as loans and partnership loans.

Furthermore, LINE is aiming to launch banking services in Japan soon, too. LINE Financial and Mizuho Bank are preparing to establish a new user-friendly “smartphone bank” connected to the LINE app, with the intention of establishing a new bank in Japan within fiscal year 2022 (between April 2022 and March 2023, subject to approval by the relevant authorities).

Looking back on the past year, we have seen many shifts in every part of our lives — in how we live and work — including how we pay for items, save, transfer money and get loans. As we head into the new year, LINE is determined to continue developing our digital financial services, creating a smart financial ecosystem that everyone can carry with them.

To learn more about how LINE BK was developed and became popular, you can also check out this video about a LINE BK engineer who has been part of this journey from the beginning: